Why Choose Ziffy Mortgage?

Fast, Simple

Short-Term and Long-Term Loans

Qualify using rental income (no personal income, W-2 or tax returns). Simplified underwriting for faster closings with short-term DSCR loans and long-term fix & flip and bridge loans.

Investment Property

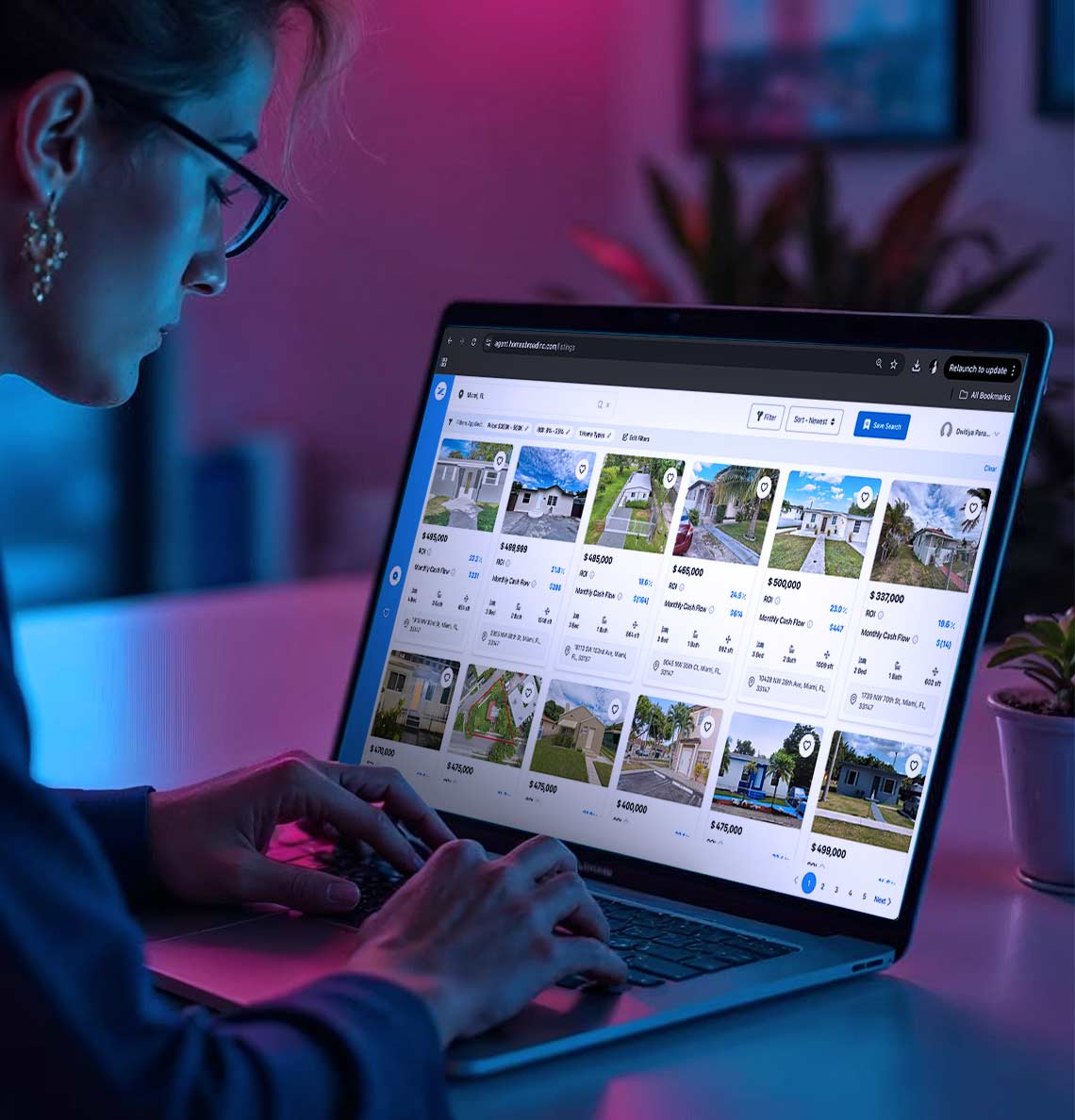

Search in “A Few Clicks”

Find your next investment property in minutes with Ziffy. Easily browse properties, then instantly check your monthly cashflow and ROI with a one-click property analysis.

Quick Approvals with Expert Guidance

Our experienced loan officers ensure smooth and fast approvals, guiding you. Get competitive mortgage rates and personalized support to maximize your investment returns.

Transparent Process with No Hidden Costs

Our straightforward process ensures you understand each step of your mortgage journey, with no hidden fees or surprises. Focus on your investment while we handle the details.

Tailored Mortgage

Loan Programs To

Suit Your

Investment Needs

DSCR Loan

Bridge Loan

Fix & Flip Loans

Full Documentation Loan

How The Loan Works

How The Loan Works

Find Investment Property

Find an investment property with Ziffy’s AI-Driven Investment Search Engine and get curated property listings, cashflow and profitability analysis.

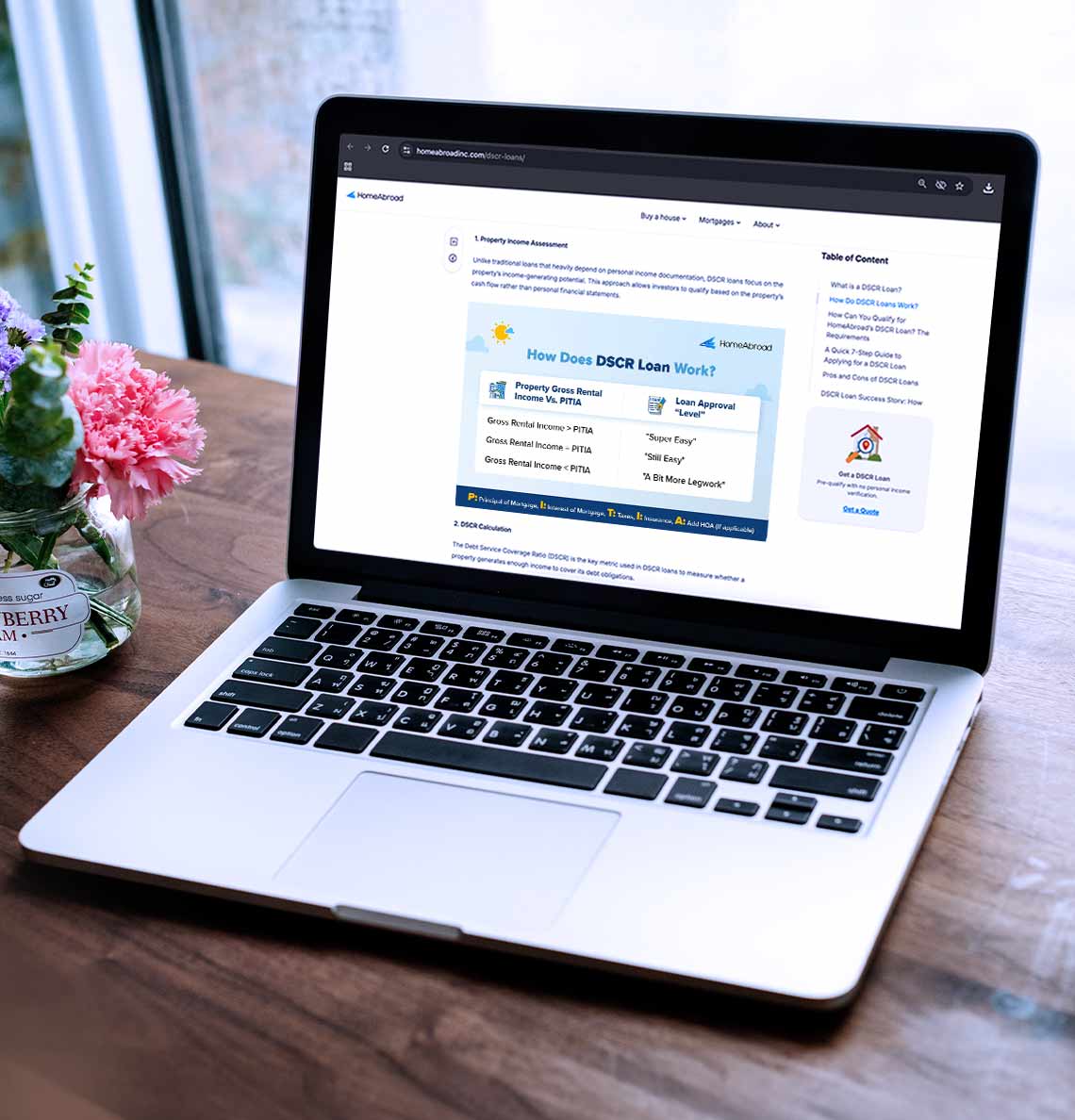

Property Income Assessment

Check rental income potential with Ziffy’s AI-Driven Investment Property Search Engine. Qualify seamlessly with DSCR loan—no personal income needed.

DSCR Calculation

Our DSCR Calculator is designed to help you assess a property’s eligibility by measuring its ability to generate sufficient income to cover its debt obligations.

Get Pre-Approved and Close

Speak to our local investor-friendly real estate agents, submit your documents and get pre-approved with the help of our expert loan officers and close on your investment property with ease.

At Ziffy Mortgage Exclusive

Get The Best

Mortgage Rates

Lock in a highly competitive rate tailored for investors. Our specialized loans ensure the most favorable terms to maximize returns on U.S. real estate.

AI-Driven Investment

Property Search Platform

Discover top investment properties with curated listings, cash flow and profitability analysis and real-time market alerts. Maximize returns with minimum risks.

One Stop Shop for

Investment Properties

Get everything under one roof—AI driven investment property search, investor-friendly agents, specialized finance, LLC setup, and opening US bank account.